Step up your marketing strategy in 2021.

The pandemic has changed the way businesses operate this year, prompting the world to think of ‘new normal’ ways. With these five ways to step up your marketing strategy in 2021, you can lead your small business to work remotely, attract a wider audience, and generate increased sales.

5 Ways to Step Up Your Marketing Strategy in 2021

5 Ways to Step Up Your Marketing Strategy in 2021

Whether it’s to boost sales or ensure customer retention, managing a business in 2021 involves combining pre and post-COVID marketing strategies. By embracing automation, developing useful content, and fortifying your brand, you can make your business stay relevant in the coming year and drive value to your products or services.

BUILD A STRONG BRANDING WEBSITE

The pandemic has pushed 58% of the world’s population to go online to work, study, and connect. Creating an eye-catching logo or a witty business name wouldn’t do the trick alone; you need a website that would enable you to reach a wider audience.

- Showcase your best creations and beat the competition. For instance, one of the most effective marketing strategies for photographers is to add visuals to their content to prove the quality of work.

- Use photographs that would show how your business can help individuals or companies navigate through global change.

- Introduce yourself as a relatable small business owner who can contribute to families and communities. You can also present your team and show working conditions through photos.

EDUCATE WITH YOUR CONTENT

About 77% of internet users read blogs, making blogs the 5th most trustworthy online information source. Creating relevant content positions you as an expert in your industry, allowing your personal branding to subconsciously speak to consumers.

Blog content like how-to guides, listicles, and instructional images build audience trust that you have a solid foundation about your niche or industry.

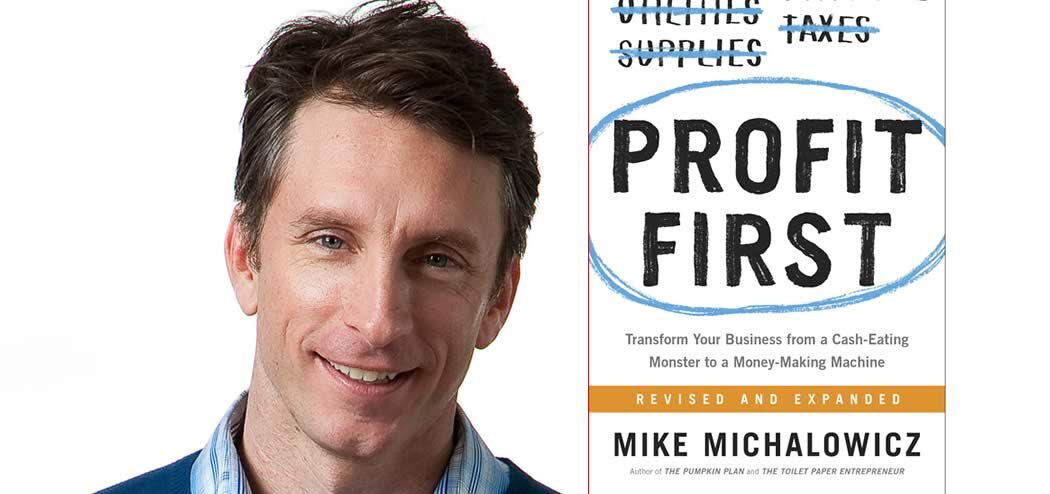

EMBRACE AUTOMATED MARKETING

About 82% of marketers gained a return on investment due to marketing automation’s cost-effectiveness. Working from home can sometimes blur the line between personal and business hours. When it’s time to rest or bond with your family, mailing list providers like Mailchimp lets you keep up with clients and networks.

DEVELOP PERSONAL AND ONLINE CONNECTIONS

Building a business network is an unending process. Your personal and virtual circles can be your most valuable marketing assets to grow clientele in 2021.

- Dive into the online world and attend conferences, webinars, or peer groups where you can meet new clients.

- Collaborate with your local community. These may be family, neighbors, or other businesses in your area.

- Use social media if you’re working on a tight budget. With the lockdown causing about 3 billion people to use Facebook’s apps, you can gain traffic and response by engaging with your followers and friends list.

Running a business is like taking care of a family — it needs your patience, presence, and attention to nourish it. Likewise, engaging with customers is like parents connecting with their children; it requires participation, authenticity, and personal voice.

COLLABORATE AND INCENTIVIZE

Managing a business isn’t a solo project. You’ll need support in various forms — family, friends, business partners, connections, mentors, and clients. Giving out incentives is one of the best ways to make the collaboration mutually beneficial, with 75% of consumers more likely to purchase again after getting an incentive.

Reward the client’s loyalty or purchase through freebies or discount codes. You can even use your email list for sign-up offers. You can partner with businesses that share your audience and do cross-promotions with them through blog posts, referrals, or exchanging of branding photos.

Lastly, don’t forget to thank everyone; human connection and appreciation can prompt people to remember that you value their contribution to your business.

Final Words

While marketing may seem daunting and overwhelming, planning for it can help seize opportunities, serve customers, and make your brand known. Start with one or two of these tips until you can combine all of them strategically for the coming year. At Utility Avenue, we are committed to help you thrive.

Guest post by Shootproof

This article was published first in Odette Photo+Art

By now, you might know what Utility Avenue is.

By now, you might know what Utility Avenue is.