Online teaching jobs are all the rage right now. If you’ve considered teaching online, this is definitely the time to do it. The pandemic has shown educators that they’re capable of more than they ever thought possible. So many have discovered they actually really enjoy teaching online. So that begs the question – where are the best online teaching jobs? And what are the best companies to work for?

In this article, you’ll learn all about the top 5, absolute best teaching jobs out there. Then, pick the path that’s best for you!

Let’s get into it.

Best Online Teaching Jobs

Online Teaching Jobs with Magic Ears

Being a teacher for Magic Ears seriously is one of the best online teaching jobs out there in 2020.

This online ESL company doesn’t get enough love.

Firstly, it’s important to note that Magic Ears is one of the highest online English teaching jobs out there!

Did that get your attention? Good, because there’s more.

Secondly, their platform is super fun and engaging. Kids love using it, and teachers enjoy facilitating instruction with it.

Thirdly, they have a very flexible cancellation policy. This is especially great if you want to teach English online with multiple companies or teach full-time at a brick-and-mortar school.

As online teaching jobs go, Magic Ears is one of our favorite companies.

Requirements

To be hired, applicants must:

- Passionate about teaching! The smiles should come through. 🙂

- Be an English native speaker from the U.S. or Canada.

- Hold a bachelor’s degree or higher in any subject, or be a student actively pursuing a bachelor’s degree (must provide official transcript)

- Have a 120-hour ESL Certification*

- ESL/teaching experience preferred

Please note that they are currently holding California residents’ applications due to AB5 restrictions (as are most other companies that hire home-based, online English teachers).

Technology Requirements

After you consider your personal qualifications, you should consider the technology you have available to you.

- Computer with: CPU: i5-6200 and newer generations.

- At least 4GB RAM

- Stable internet connection with: Upload speed: 5Mbps. Download speed: 20Mbps.

- An “over-the-ears” headset with microphone.

Please note that teachers cannot use in-ear headphones to teach classes.

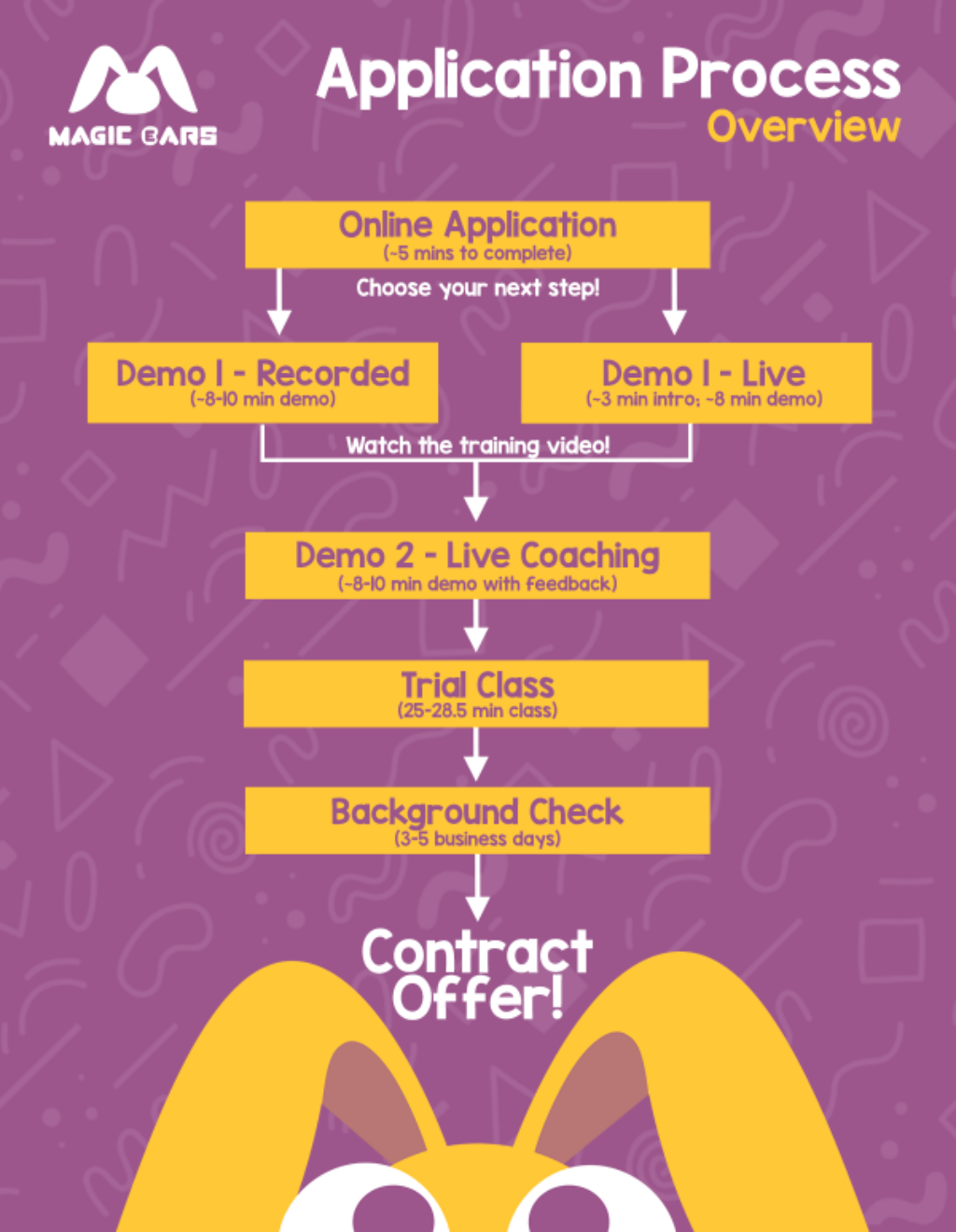

Application Process

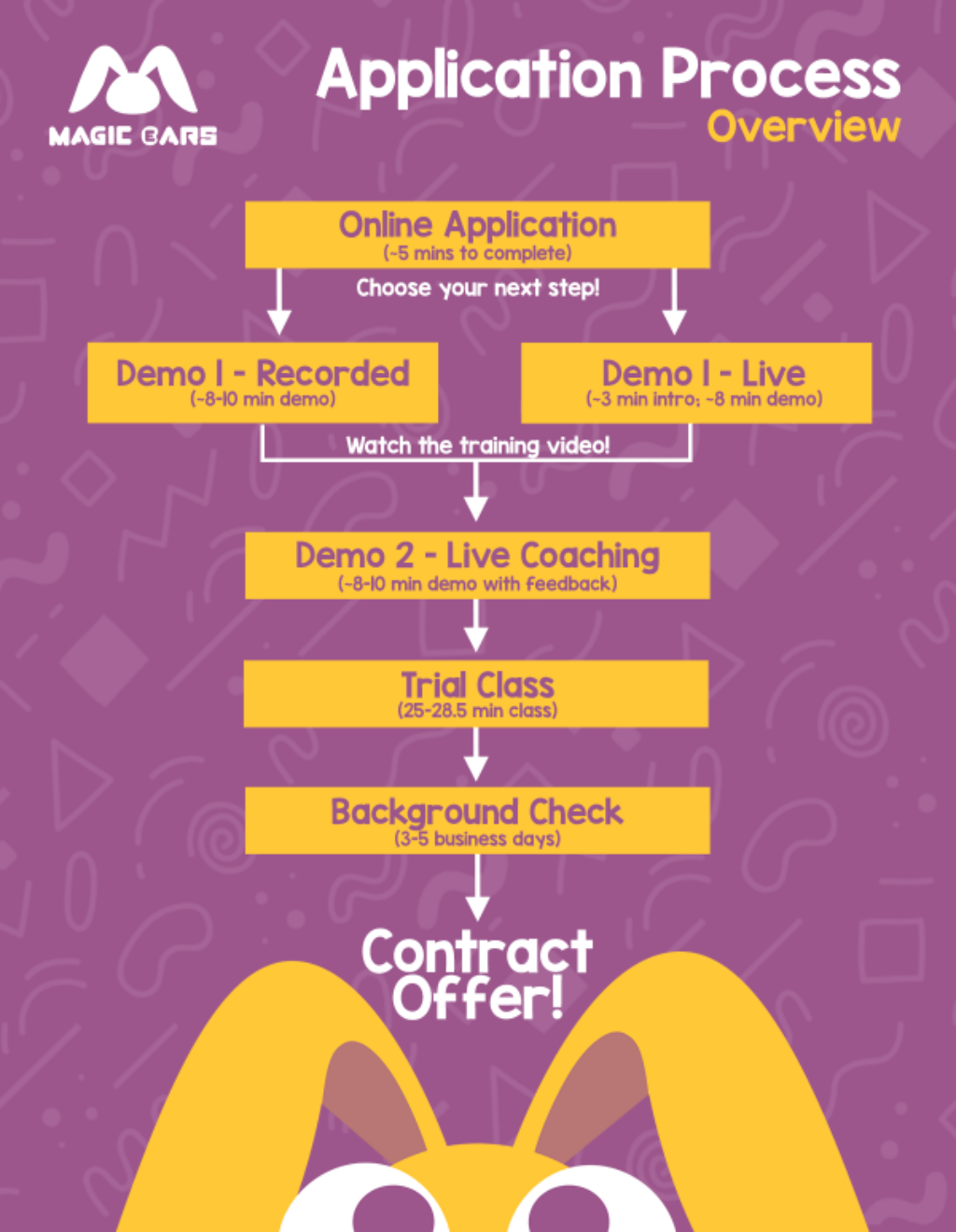

This image is directly from their website, and it outlines the application process with Magic Ears:

When you apply, allow up to 2 business days for processing at each step.

Throughout the application process, there are two places where you can find updates on your application’s status:

- The email with which you applied (check your spam folder).

- The Teacher Portal

Once you start the application process on the teacher portal, you can use the “Contact Us” link in your portal to easily reach out to Magic Ears when needed.

Payment

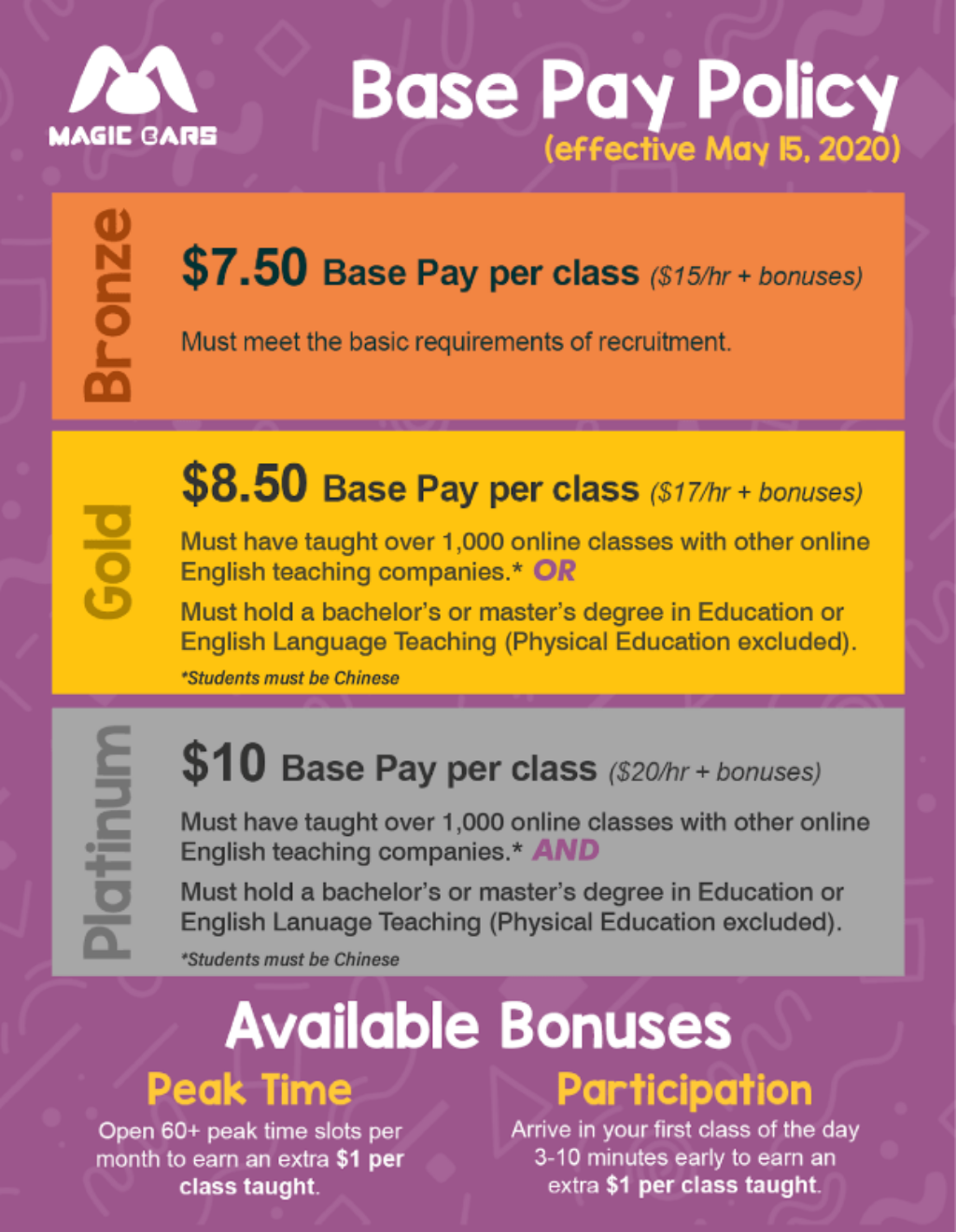

The payment system for most online teaching companies can be a bit confusing.

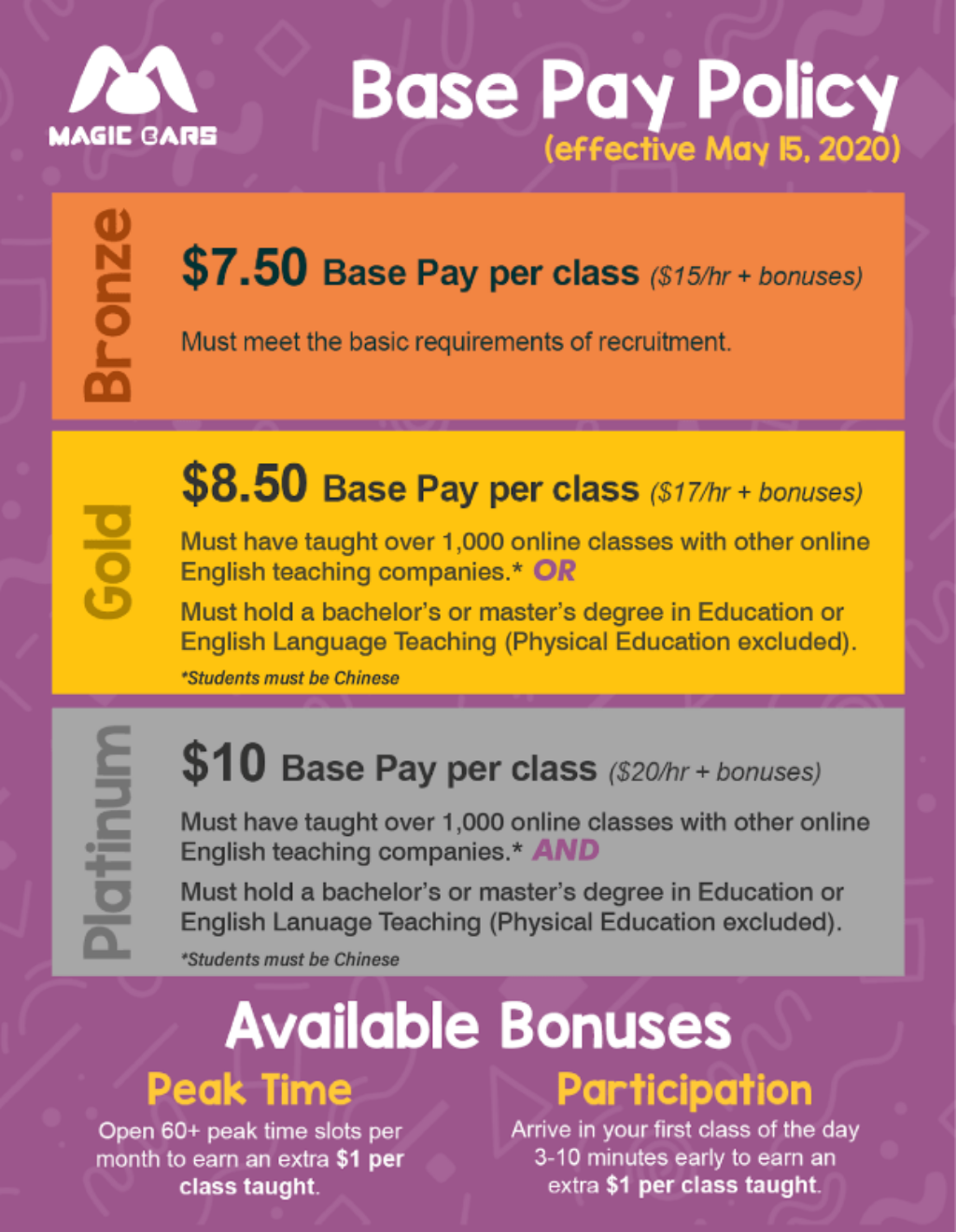

Their base pay ranges from $7.50-$10 per class depending on qualifications.

With the two available bonuses, your base pay can rise to $9.50-$12 per class for a total of $19-$24/hr. Most online teachers with Magic Ears are earning between $17 and $26 per hour.

The photo below better explains the pay structure for Magic Ears:

Online Teaching Jobs with iTutor Group

iTutor definitely ranks as being one of the best online teaching jobs available in 2020!

One teacher in our group made over $1,000 in ten days, just from teaching online with iTutor Group.

Imagine what you could do in a month!

Unlike other online teaching jobs, the company schedules bookings for you.

This means it’s easy for new teachers to break into the market and earn quickly.

Requirements

To to be hired, applicants must:

- Uniquely, iTutor Group does not require teachers to be native speakers.

- Bachelor’s degree or higher

- TESL, TEFL, or TESOL certification

- Minimum 5 hours of availability per week during peak times in China.

Please note that they are currently holding California residents’ applications due to AB5 restrictions (as are most other companies that hire home-based, online English teachers).

Technology Requirements

After you consider your personal qualifications, you should consider the technology you have available to you.

- Desktop/Laptop PC: Intel Core2 Duo processor or better (no netbook or tablet).

- Windows operating system: Windows 7 or 8 Internet Explorer web browser: Version 9 or higher. Mac: OS 10.11.12 or above (no iPad)

- RAM: 2GB or more

- Internet Speed: Minimum 800 Kbps download, and 500 Kbps upload wired internet connection: Cable, DSL, or Fiber Optics (no wireless connection).

- Webcam: Either built-in or preferably high quality Creative, Logitech, or comparable.

Please note that teachers cannot use in-ear headphones to teach classes.

Application Process

The application process for iTutor Group is very straightforward.

- Apply (very quickly!)

- Select an interview time (you’ll be contacted if you pass the initial screening)

- You’ll hear back about your interview result quickly – usually, it’s a matter of days.

- Once you’re good to go, you’ll set your availability and start teaching!

Payment

Your payment includes a basic rate, with incentives added on top of that.

Performance bonuses compound upon each other each month, depending on some factors, including how students rate you and how often you teach.

Online Teaching Jobs with GoGo Kid

Online teachers who work with GoGo Kid often cite how much the company cares for its employees.

This is why we’ve included it on our best-of list of online teaching jobs for 2020.

Another factor that sets GoGo Kid apart is the fact that you can teach online with GoGo Kid from anywhere in the world, so long as you’re eligible to be hired with them.

GoGo Kid has some of the most flexible requirements of any online ESL teaching company out there. However, it also means it can be competitive.

Be sure that you read all of the requirements and follow all instructions correctly the first time!

Requirements

To teach online with GoGo Kid, applicants should:

- Hold at least a Bachelor’s degree.

- Have at least one year of experience working with children

- Have a stable internet connection

- Be willing to communicate not only with the students but also with the parents.

Technology Requirements

After you consider your personal qualifications, you should consider the technology you have available to you.

- System: Mac OS 10.8x or higher. Windows 7, Windows 8, Windows 10, or higher.

- Memory & CPU: At least 4GB RAM, Intel Core i3 above

- HD External camera or HD integrated camera.

- A headset with a microphone, stable output, and input

- Wired DSL Internet Connection – at least 20 Mbps

Application Process

The application process for GoGo Kids is also very easy compared to other online teaching jobs out there.

- Complete an online application (Sign up + Basic Information)

- Schedule an interview

- Attend an orientation program

- a. Orientation Quiz

- b. One-to-Many Live Training Session

- c. One-on-One Mock Class Training Session

- Submit the paperwork

- Sign the contract

Payment

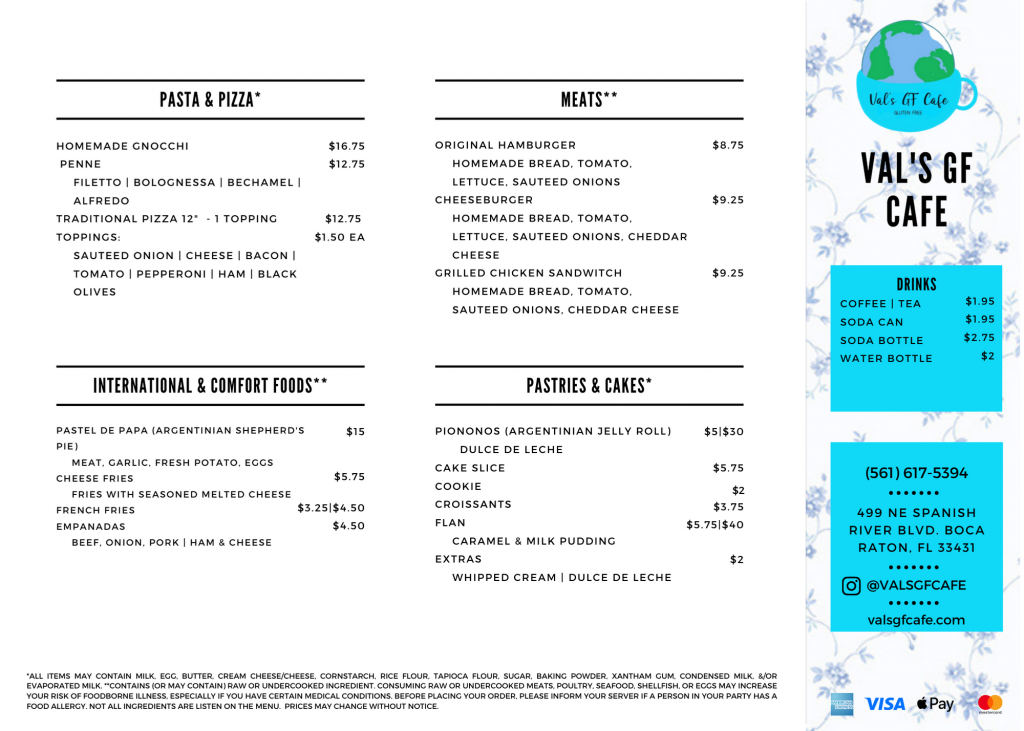

Your payment includes a basic rate, with incentives added on top of that.

Performance bonuses compound upon each other each month, depending on several factors, including how students rate you and how often you teach.

Check out their payment matrix below:

| Class Payment |

Per Class |

Remarks |

| Base Pay(Level 1) |

USD 7~10 |

based on your credentials and interview performance. |

| Base Pay(Level 2) |

USD 7~10 |

based on your credentials and interview performance. |

| Credit Score(Level 3) |

USD (7~10)+($1.5~$2)*100% |

Today’s Credit Score and Classes Completed Today |

| Credit Score(Level 4) |

USD (7~10)+($1.5~$2)*110% |

Today’s Credit Score and Classes Completed Today |

| Credit Score(Level 5) |

USD (7~10)+($1.5~$2)*125% |

Today’s Credit Score and Classes Completed Today |

| Total per one hour |

USD 14~25 |

|

Online Teaching Jobs with Q Kids

QKids is known in the online teacher world as having one of the most flexible cancellation policies.

Limited Attendance policies require 24-hour notice for schedule changes and a minimum of 5-hour notice to maintain overall attendance fee eligibility.

This makes it a great supplementary income stream for educators teaching online through other platforms.

The teaching style is also different, as everything is taught through games and play.

Requirements

To teach online with Q Kids, an applicant should be:

- Eligible to legally work in the U.S. or Canada

- Holding a Bachelor’s degree

- Certified with a teaching license or holding an English teaching certificate (TESOL, TEFL, CELTA, ESL)

- These are all required before lessons are assigned.

Technology Requirements

As it is with any online teaching company, technology requirements must be considered.

Here are the minimum technology requirements for those seeking online teaching jobs with Q Kids:

- Minimum upload speed: 2Mbps. Minimum download speed: 4Mbps.

- Test your speed here: http://www.speedtest.net/

- *Cable connection is recommended.

Application Process

Here’s the application process with Q Kids:

- Apply with all required materials

- Initial screening

- Demo Interview 1

- Demo Interview 2

- Trial Classes & Background Check

- Secure your contract!

Payment

Q Kids has an involved pay structure, so see the full details laid out below:

- $4 base pay for standby lessons (approximately 10 minutes with no teaching required).

- $1 Performance incentive for each lesson based on family review

- $1 Attendance Bonus for each lesson once a minimum of 15 lessons are taught in a week.

Online Teaching Jobs with VIP KID

Of course, I’d be remiss to exclude VIP KID when discussing online teaching jobs!

VIP KID is possibly the juggernaut of the industry.

On top of being one of the most popular TESL company, they also offer multiple revenue streams to teachers.

On top of teaching English online, you can earn incentives for completing classes and recruiting other people to become VIP KID teachers!

Requirements

To be eligible to apply for VIP KID, you must have:

- A Bachelor’s degree (can be in any field)

- Work authorization for the U.S. or Canada

- Two years of experience teaching, coaching, tutoring, and/or mentoring

- Highly reliable technology

Technology Requirements

Since VIP KID is such a well-established company, it has a reputation to uphold.

This means they have some pretty weighty technical requirements:

- Desktop, Laptop, Macbook, iPad, or Microsoft Surface (no Chromebooks)

- Windows 7, 8, and 10; Mac OS 10.X or higher operating system (Linux and Chrome OS are NOT supported by VIPKid)

- Intel i5 processor or higher

- 8GB RAM or higher

- Fast and stable internet connection will make a smooth teaching and learning experience. Ideally, a wired high-speed internet connection of ≥ 25 Mb/s

Application Process

Here’s the application process with Q Kids:

- Apply with all required materials

- Initial screening

- Demo Interview 1

- Demo Interview 2

- Trial Classes & Background Check

- Secure your contract!

Payment

Here are all of the ways to maximize your income with VIP KID:

- The base pay rate is $7-$9 per class

- $1 attendance bonus per class

- Extra $0.50 for every class taught after teaching a minimum of 30 lessons in a month

- Extra $1 for every class taught after teaching 45 classes in a month

References

Brittany Verlenich published this guest post first here: https://travelingteachers.co/2020/08/06/the-5-best-online-teaching-jobs-in-2020/

Join the Traveling Teachers community. They’re committed to helping you find your perfect path to teaching online.

_______________________________________

Utility Avenue’s Spotlight focuses on promoting inspiring businesses every week. For a chance to be interviewed, contact us at support@utilityavenue.com with the subject Spotlight.